How AI Improves Risk Management in Stock Trading

AI for Risk Management in Finance: Revolutionizing Stock Risk Analysis and Trading Strategies

Risk is one of the pillars of financial trading and investments. In today’s economic environment, characterized as by the high frequency/fast trading era, the effective risk management is challenging and needs new approaches. As technology has advanced, artificial intelligence (AI) has become a game-changer in risk management for finance. AI is changing the way financial institutions and investors whether corporations or individuals, analyse and manage risks using sophisticated algorithms, learning models and insights driven by data.

In order to answer these questions, we will cover what is AI for risk management in finance, what is an artificial intelligence for stock risk analysis and, of course, the importance of machine learning in financial risk control. We’ll explore the pros and cons of AI in investment risk management, and the future of AI and trading risk management. In this article, you will learn more about the ability of AI to disrupt risk management in finance.

Introduction: The Role of AI in Financial Risk Management

There are risks in financial markets, and whether you’re trading stocks, bonds, or derivatives, it’s possible to lose money. Risk Management is a key to every investor / trader so as to not get caught in market bubble, external shocks or misadventures. Traditional risk management solutions typically rely on manual analysis, historical data and models, however AI and machine learning algorithms have disrupted this process.

As AI can process and analyze incredible amounts of data in real time, recognize patterns and even predict risk, it has become especially useful for stocks risk analysis. The deployment of AI in to trading and investment process not only increases the efficiency of risk detection, but also substitute many manual intervention processes.

AI in financial risk management and fintech From trading to financial risks AIs can now text: The tech behind the future trends in trading Risk Management in an AI World AI for detecting risk in trading Also machine learning in financial risk control How AI is shaping the future of risk management in finance.

AI for Risk Management in Finance

Artificial intelligence is at the heart of financial risk management today. It enables financial institutions, hedge funds, asset managers and retail traders to better evaluate, quantify and manage their risk. Let’s examine how AI is used in various areas of risk management within the financial sector.

1. Predictive Risk Modeling with AI

The AI-powered risk management start with predictive models that are able to predict the risks using the past and live market data. These combine data analysis, pattern recognition and the prediction of future market behavior through machine learning. Artificial intelligence – by detecting patterns and relationships that traditional methods might overlook – can act as an early warning system for such risks.

For instance, AI models can make predictions about how certain economic events (e.g., varying the interest rates, employment rates, or geopolitical uncertainty) would affect the financial markets. The ability to predict those risks means that traders can take preventative measures such as winding down portfolios or hedging against unfavourable moves.

2. Machine Learning for Financial Risk Control

Machine learning in financial risk control has been one of the most effective risk management tools in financial markets. Once modelled, machine learning algorithms can analyze new data on an ongoing basis, so risk models can evolve in real time. The difference with traditional approaches where the response is typically based on static assumptions: ML models get better with age as they learn from newer data and update predictions.

How Machine Learning Works for Risk Control:

Data Inputs: Machine learning algorithms find patterns in the increasingly available big data, such as past prices, volumes, economic data or market sentiment, to forecast the probability o risk events.

Model Training: Based on historical data, the machine learning algorithm gets trained to find patterns and correlations between various risk factors.

Real-Time Monitoring:

The model is constantly updating as new information comes in, making real-time risk adjustments and predicting numbers.

Machine learning models are especially effective in detecting patterns of risk that human analysts may miss. These models can also account for non-linear relationships in the data, which traditional models may fail to capture.

3. AI in Portfolio Risk Management

Risk management is essential for any investor or trader. AI can suggest optimal allocation of assets between them and sort of align them with the investor’s goals and risk appetite. AI can follow the real-time monitoring performance of a portfolio, considering market backdrop, economic events and risk factors, and take actions.

AI’s Role in Portfolio Risk Management:

Dynamic Rebalancing: AI models constantly watch your portfolio, rebalancing it in real-time to minimize your risk.

Risk Assessment: Machine learning tools assess the risk level of each individual asset in the portfolio and recommend strategies to mitigate risk (e.g., by diversification or hedging).

Scenario Analysis: AI can replicate different trading environments and forecast how a portfolio will perform in various risk situations which aid investor decisions.

Artificial intelligence (AI) powered portfolio risk management tools help investors manage risks efficiently by tweaking their portfolios in the light of predictive insights.

Artificial Intelligence in Stock Risk Analysis

1. AI-Powered Stock Risk Analysis Tools

AI is especially good at stock risk analysis since it can handle big data sets from various sources. Looking for signs of trouble Through analysis of historical stock quotes, market news and economic data, AI is designed to catch on to patterns that indicate heightened risk to an individual stock. Such systems can also evaluate the volatility level of stocks and predict how the stocks will behave in various market situations.

Key Benefits of AI in Stock Risk Analysis:

Real-Time Analysis: AI can process real-time data, allowing traders to identify stock risks as soon as they arise.

Volatility Forecasting: Artificial intelligence instruments can forecast stock price volatility using market data, enabling investors to gain insight into potential risks.

Sentiment Analysis: It employs NLP (natural language processing) to parse sentiment from news articles, social media and analyst reports in order to recognize factors that could impact stock prices.

For instance, AI can monitor news events and evaluate their effect on stock risk, by considering how similar past events influenced the market. This enables travelers to tweak their game plan ahead of potential threats.

2. Risk Detection with AI in Trading

AI detection of risk in trading is important for traders who have high frequency trading and must make real time decisions. AI models can uncover abnormalities in trading patterns, scan asset prices for sudden changes, and predict risks in the form of price crashes or flash crashes.

How AI Detects Risk in Trading:

Anomaly Detection: AI algorithms study trading numbers and spot suspicious patterns – an unusual price or size of a deal, or a sudden jolt in virility around stocks – that might be signs of danger.

Event-Driven Risk Alerts: Artificial intelligence models can pick up news sources and social media chatter to provide real-time alerts on events that might influence stock prices or market sentiment, enabling traders to react swiftly.

Predictive Risk Analysis: AI can estimate a probability of extreme market events (crashes or flash crashes) and guide a risk management ahead.

By detecting potential risks early, traders can take actions to hedge their positions or adjust their strategies accordingly.

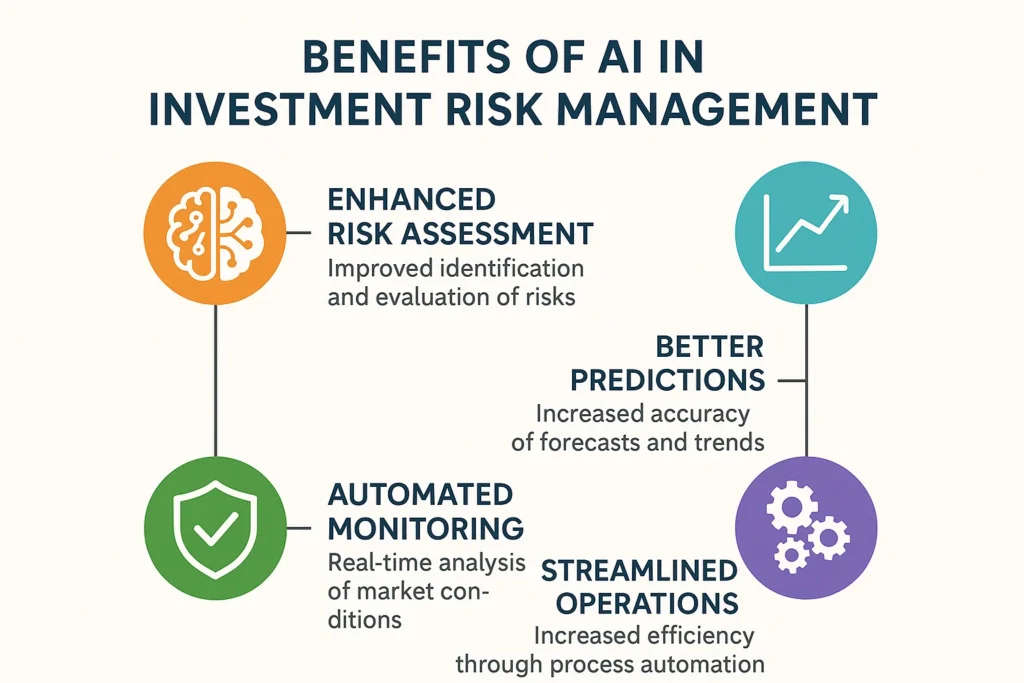

Benefits of AI in Investment Risk Management

AI has a lot to offer in terms of investment risk management, particularly in the case of institutional investors, hedge funds, and asset managers. Investors can also more effectively manage their risk with AI by automating risk analysis, portfolio optimization, and real time decision making. Here are some of the highlights:

1. Real-Time Risk Monitoring and Alerts

13 AI tools that provides real-time risk check and it’s essential in current high-speed financial markets. AI tools are much better further than that; By always scanning all the relevant market data, economic clashes, and other threat factors, AI software can notify traders about potential risks when they just appear. It allows investors to act fast and minimize their losses.

2. Enhanced Accuracy in Risk Prediction

AI models are trained to spot faint signals in large data sets, which human researchers might overlook.”– CFA Institute READ THE ARTICLE AI’s deep learning networks are able to sift through various forms of historical data and real-time market data and produce more accurate risk event predictions on which investors can act to better manage their portfolios and reduce risk.”–Wall Street CIO

3. Automation of Risk Management Processes

AI-based systems can help automate a variety of risk management functions including portfolio rebalancing, risk analysis, risk categorization and asset allocation. Automation minimizes the possibilities of human error and ensures that risk management is implemented around-the-clock, in times of high market volatility as well.

4. Data-Driven Insights

AI helps investors to make their investment decisions based on a data, studying the big data sets which will help to understand the market conditions and risks. These findings can help investors to select the best investment policies, so as to obtain higher interests and lower risks.

The Future of AI in Trading Risk Management

The upcoming years will bring significant promise to AI applications in trading risk management systems. The development of advanced AI algorithms will boost risk management operations while improving predictive accuracy and delivering enhanced risk management tools to traders and investors.

1. AI-Powered Risk Control in High-Frequency Trading

AI technology will drive significant advancements in High-frequency trading operations during the upcoming period. AI models will advance their risk management capabilities for HFT by delivering instant market data analysis and volatility and sentiment insights. The ultra-fast decision-making capabilities of AI systems will allow traders to execute trades at optimal times while reducing their exposure to risk.

2. Advanced Machine Learning for Risk Forecasting

Machine learning models will advance their capabilities to make better predictions. The models will develop the ability to forecast both market trends and intricate risk situations which include financial crises and market crashes and sudden price movements. Accurate risk forecasting will enable investors and traders to develop proactive strategies for potential market downturns.

3. Integration of AI and Blockchain for Risk Management

AI and blockchain technology will collaborate in the future to establish risk management systems which will be both secure and transparent and operationally efficient. Financial institutions and investors will gain access to a stronger risk management system through the combination of blockchain transparency and security with AI data analysis and prediction capabilities.

4. More Accessible AI Tools for Retail Investors

The future will bring sophisticated AI-based risk management tools to retail investors which will make financial risk management accessible to all. The tools will deliver customized risk evaluations and automated trading systems and portfolio optimization capabilities which will enable retail investors to access institutional-grade AI technology.

Frequently Asked Questions (FAQs)

1. How does AI help in risk management in finance?

AI performs risk management through its ability to process extensive data sets while detecting patterns and making risk probability forecasts. The system enables automated risk assessment and portfolio optimization and real-time monitoring which allows investors to take early preventive measures against risk exposure.

2. Can AI predict financial crises?

AI systems lack the ability to predict financial crises with absolute certainty but they can detect early warning signs through economic data analysis and market trend evaluation and historical pattern recognition. Through its analysis AI systems offer risk assessment capabilities that help investors prepare for potential market declines.

3. What are the benefits of AI in investment risk management?

AI-based investment risk management offers real-time risk monitoring alongside improved risk prediction accuracy and automated risk management capabilities and data-driven insights to enhance investment strategies.

4. How accurate are machine learning models in predicting financial risks?

Machine learning models achieve high accuracy in financial risk prediction through their ability to process extensive datasets combined with continuous real-time data updates. The accuracy of predictions depends on both data quality and current market conditions.

5. What is the future of AI in trading risk management?

The future of AI in trading risk management will include sophisticated machine learning models for risk forecasting and AI-powered risk control in high-frequency trading as well as blockchain integration for enhanced security and transparency and more accessible AI tools for retail investors.

Conclusion: AI’s Impact on Risk Management in Finance

AI in risk management is transforming the finance industry. Artificial intelligence models deliver better forecasts, immediated insights and operational automation to help traders, investors and financial institutions reduce risk and enhance their strategies. From portfolio allocation to high-frequency trading and financial risk assessment, AI is now an integral part of managing financial risk.

AI’s role in risk management will become all the more crucial as the technology becomes more developed. The horizons of AI in trading risk management are vast due to a fast progress in the development of sophisticated machine learning algorithms — control over risk in the field of finance will soon begin to be more effective, faster, and available not only to professional market players, but also to retail investors. AI will allow financial markets to sail through uncertainty and volatility with more accuracy and confidence than ever before.

Best AI Trading Bots for Crypto